Currency correlations are a critical concept in forex trading, offering insights into how currency pairs interact with each other. By understanding these relationships, traders can manage risk, improve strategy efficiency, and make informed trading decisions. In this blog, we will explore what currency correlations are, how they work, and how to incorporate them into your trading practices.

What Are Currency Correlations?

Currency correlations measure the degree to which two currency pairs move with each other. Correlations are expressed as a coefficient ranging from -1 to +1:

- +1 Correlation: Indicates that two currency pairs move in perfect harmony. If one pair rises, the other also rises proportionally.

- 0 Correlation: Suggests no relationship between the movements of the two pairs.

- -1 Correlation: This means the currency pairs move in opposite directions. If one pair rises, the other falls.

Example:

- EUR/USD and GBP/USD often show a positive correlation because both pairs are influenced by the U.S. dollar.

- USD/JPY and USD/CHF may show a negative correlation under certain market conditions.

Why Currency Correlations Matter

Understanding currency correlations provides several advantages for forex traders:

- Risk Management:

- Avoid overexposing your account by trading highly correlated pairs in the same direction.

- Use correlations to hedge positions and minimize losses.

- Improved Trade Accuracy:

- Analyze correlations to confirm signals and validate trade setups.

- Diversification:

- Trade uncorrelated pairs to diversify your portfolio and reduce overall risk.

- Enhanced Strategy Development:

- Incorporate correlation data into your strategy to align trades with broader market trends.

Factors Influencing Currency Correlations

Currency correlations are not static; they can change over time due to various factors:

- Economic Events:

- Interest rate decisions, GDP reports, and employment data affect currency movements and correlations.

- Market Sentiment:

- Risk-on and risk-off sentiment shifts can strengthen or weaken correlations.

- During risk-off periods, safe-haven currencies like the USD and JPY often exhibit stronger correlations.

- Geopolitical Developments:

- Political stability, trade agreements, and geopolitical tensions influence correlations.

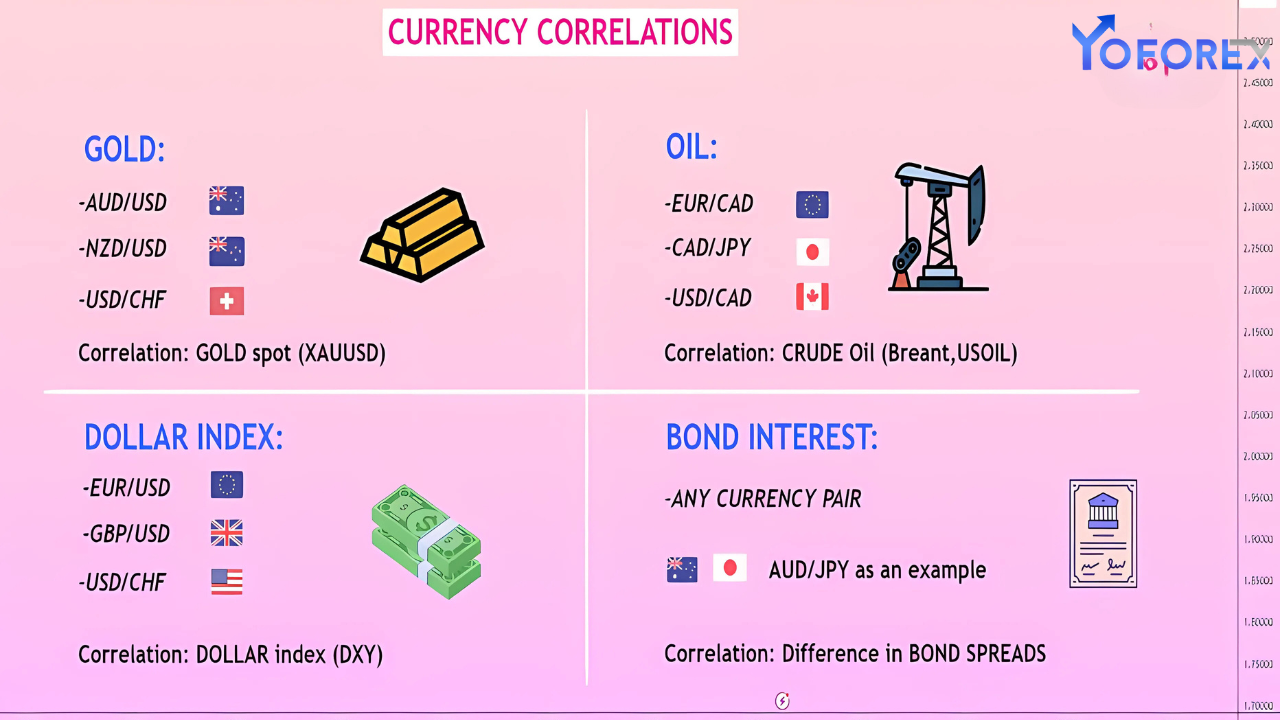

- Commodity Prices:

- Currencies tied to commodities, like AUD (gold) and CAD (oil), may correlate with commodity price movements.

Examples of Common Currency Correlations

- Positive Correlations:

- EUR/USD and GBP/USD: Both pairs often move in the same direction due to their shared relationship with the U.S. dollar.

- AUD/USD and NZD/USD: Both are influenced by the commodity-driven economies of Australia and New Zealand.

- Negative Correlations:

- USD/JPY and EUR/USD: When the USD strengthens, USD/JPY typically rises while EUR/USD falls.

- USD/CHF and GBP/USD: The Swiss franc and British pound often move inversely about the U.S. dollar.

Calculating Currency Correlations

Currency correlations are typically calculated using historical price data and statistical methods. Many trading platforms and tools offer built-in correlation calculators.

- Correlation Coefficient Formula:

- Use the Pearson correlation coefficient formula to measure relationships between currency pairs:

- Interpreting Results:

- +0.7 to +1: Strong positive correlation.

- 0 to +0.3: Weak positive correlation.

- 0 to -0.3: Weak negative correlation.

- -0.7 to -1: Strong negative correlation.

Tip: Check correlation tables available on trading platforms for updated data.

How to Use Currency Correlations in Trading

- Avoid Overexposure:

- Trading two highly correlated pairs in the same direction doubles your risk.

- Example: If you buy EUR/USD and GBP/USD, both trades may be affected similarly by USD movements.

- Hedging Strategies:

- Use negatively correlated pairs to hedge positions. For example, if you’re long on USD/JPY, you might short EUR/USD to offset potential losses.

- Signal Confirmation:

- Cross-check signals from correlated pairs to validate trade setups. If both EUR/USD and GBP/USD show similar patterns, it strengthens the trade idea.

- Diversification:

- Trade uncorrelated or weakly correlated pairs to diversify your portfolio. This reduces the likelihood of simultaneous losses.

- Pair Selection:

- Choose currency pairs based on their correlation with external factors like commodities or stock indices. For instance, if gold prices are rising, consider trading AUD/USD.

Challenges of Trading Currency Correlations

While currency correlations can be a powerful tool, they also come with challenges:

- Changing Correlations:

- Correlations can shift due to economic events or market sentiment changes, making it essential to update your data regularly.

- False Signals:

- Over-reliance on correlations without analyzing individual currency fundamentals can lead to false signals.

- Complexity:

- Managing multiple correlated positions requires careful tracking and analysis to avoid overexposure.

Tools for Monitoring Currency Correlations

Several tools and resources can help you monitor and analyze currency correlations:

- Trading Platforms:

- Platforms like MetaTrader and TradingView offer built-in tools to calculate and visualize correlations.

- Correlation Tables:

- Websites and platforms provide regularly updated correlation tables for major currency pairs.

- Economic Calendars:

- Use economic calendars to track events that may impact currency correlations.

- Custom Indicators:

- Develop or download custom indicators to overlay correlation data on your charts.

Tips for Effective Use of Currency Correlations

- Stay Updated:

- Regularly check correlation tables to account for changes in relationships between pairs.

- Combine with Analysis:

- Use correlations alongside technical and fundamental analysis for comprehensive decision-making.

- Focus on Major Pairs:

- Start with correlations between major pairs before exploring exotic currencies.

- Practice in a Demo Account:

- Test correlation strategies in a risk-free environment before applying them to live trades.

Conclusion

Currency correlations are an invaluable tool for forex traders, offering insights into market dynamics and helping to refine strategies. By understanding and leveraging these relationships, you can improve risk management, diversify your portfolio, and enhance your overall trading performance. Remember, correlations are not static, so staying informed and adaptable is key to making the most of this powerful concept.