Crude oil is one of the most traded commodities globally and plays a vital role in the global economy. Its price fluctuations can significantly impact forex markets, especially currency pairs involving oil-exporting and oil-importing countries. Understanding the relationship between crude oil prices and currency movements is crucial for traders looking to capitalize on these correlations.

This blog explores the dynamics between crude oil prices and currency pairs, outlining how traders can use this relationship to make informed trading decisions.

The Role of Crude Oil in the Global Economy

Crude oil is a primary energy source and a key input for various industries, including transportation, manufacturing, and chemicals. As a result, changes in oil prices influence economic performance, inflation, trade balances, and, ultimately, currency values.

Key Players in the Oil Market:

- Oil-Exporting Countries:

- Nations like Canada, Russia, and Saudi Arabia depend heavily on oil exports. Rising oil prices typically strengthen their currencies due to increased export revenues.

- Oil-Importing Countries:

- Countries like Japan, India, and the Eurozone are major oil importers. Higher oil prices can weaken their currencies as they lead to higher import costs and trade deficits.

How Crude Oil Prices Influence Currency Pairs

1. Petrocurrencies

Currencies of oil-exporting countries, often referred to as “petrocurrencies,” are highly sensitive to oil price movements. Examples include:

- Canadian Dollar (CAD):

- Canada is one of the largest oil exporters globally, and the CAD often moves in tandem with oil prices. For instance, when oil prices rise, the USD/CAD pair typically falls, indicating CAD strength.

- Norwegian Krone (NOK):

- Norway’s economy relies heavily on oil exports, making the NOK another petrocurrency influenced by oil price changes.

2. Oil-Importing Nations

Currencies of oil-importing countries tend to react inversely to oil price movements. Examples include:

- Japanese Yen (JPY):

- Japan imports nearly all its energy needs, so higher oil prices often weaken the JPY.

- Indian Rupee (INR):

- India’s reliance on oil imports makes the INR vulnerable to rising crude prices, which can exacerbate trade deficits and inflation.

3. USD and Oil Price Dynamics

Oil prices are typically denominated in U.S. dollars (USD), creating a unique relationship:

- When oil prices rise, oil-importing nations may need more USD to purchase crude, potentially strengthening the USD.

- Conversely, higher oil prices can weaken the USD if they lead to inflationary pressures and concerns about the U.S. economy.

Economic Channels Linking Oil Prices and Currencies

1. Trade Balances

- Oil Exporters: Higher oil prices improve trade balances by increasing export revenues, boosting the currency.

- Oil Importers: Rising oil prices lead to higher import costs, worsening trade balances and weakening the currency.

2. Inflation

- Higher oil prices can increase production and transportation costs, leading to inflation.

- Central banks may respond with monetary policy adjustments, such as raising interest rates, which can influence currency strength.

3. Economic Growth

- For oil-exporting countries, rising oil prices often stimulate economic growth, supporting currency appreciation.

- For oil-importing countries, higher oil prices can slow growth and weaken currencies due to increased production costs and reduced consumer spending.

Case Studies of Oil Price Impact on Currencies

1. USD/CAD and Oil Prices

- Scenario: In 2020, oil prices plummeted during the COVID-19 pandemic due to reduced demand and oversupply.

- Impact on USD/CAD: The Canadian dollar weakened significantly as oil revenues declined, leading to a sharp rise in the USD/CAD pair.

- Lesson: Monitoring oil market fundamentals can provide insights into CAD movements.

2. JPY and Rising Oil Prices

- Scenario: In early 2022, geopolitical tensions caused a surge in oil prices.

- Impact on JPY: As an oil-importing nation, Japan faced higher import costs, leading to JPY depreciation against major currencies.

- Lesson: Oil price spikes can adversely affect the currencies of energy-dependent nations.

Trading Strategies Based on Oil and Forex Correlations

1. Correlation Analysis

- Use historical data to identify correlations between oil prices and specific currency pairs.

- Examples:

- Positive correlation: USD/CAD and oil prices.

- Negative correlation: JPY and oil prices.

2. Monitor Key Economic Data

- Track oil inventory reports, production levels, and OPEC announcements to anticipate price movements.

- Combine oil market insights with forex data to refine trading decisions.

3. Hedging Strategies

- For traders exposed to currencies impacted by oil prices, hedging can reduce risk.

- Example: Use currency futures or options to offset potential losses due to oil price volatility.

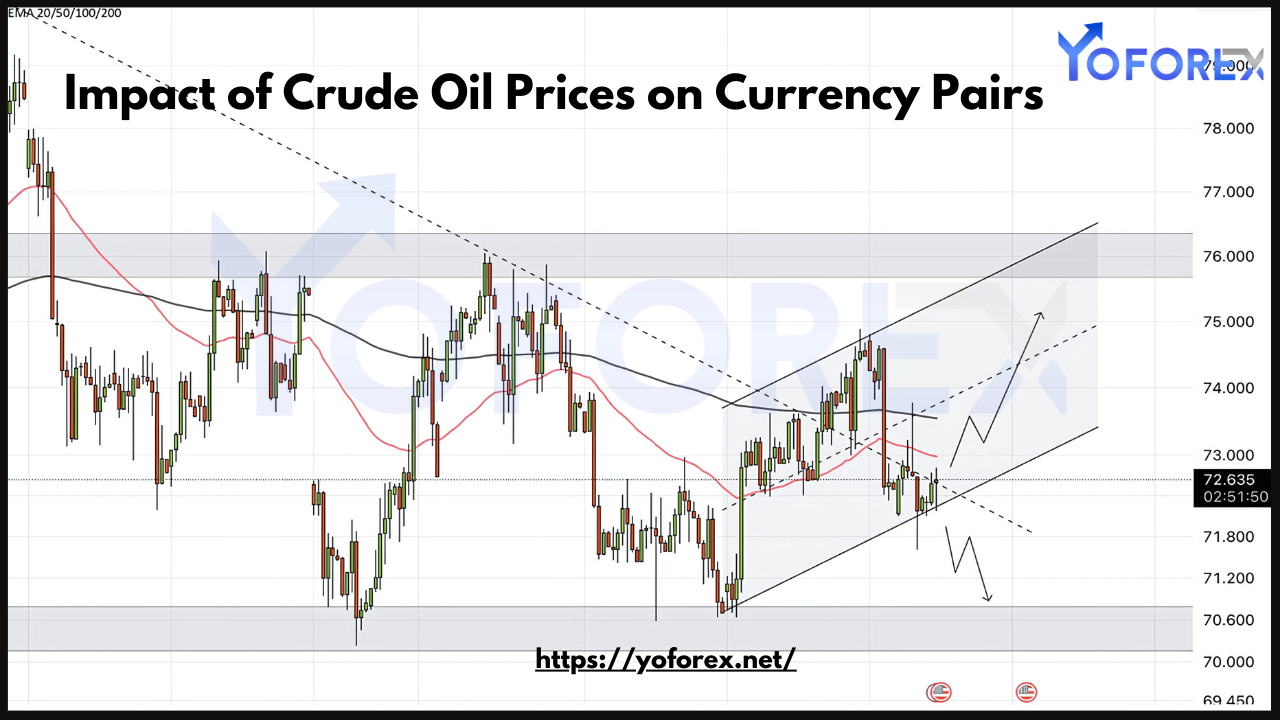

4. Use Technical and Fundamental Analysis

- Combine oil price charts with technical indicators like moving averages or RSI to identify trends.

- Incorporate fundamental analysis, such as geopolitical events or central bank policies, to validate trades.

Risks and Challenges in Trading Oil-Linked Currencies

1. Volatility

- Oil prices can be extremely volatile, driven by factors like geopolitical tensions, natural disasters, or production decisions by OPEC.

- Currency pairs linked to oil prices may experience sudden and unpredictable price swings.

2. Complex Interactions

- Oil price movements interact with other economic factors, such as interest rates and global trade, making their impact on currencies multifaceted.

3. Overreliance on Correlations

- While correlations exist, they are not static. Shifts in economic conditions or market sentiment can weaken or reverse correlations between oil prices and currencies.

Tips for Successful Trading

- Stay Informed:

- Follow oil market news, including OPEC meetings, inventory data, and geopolitical developments.

- Diversify Trades:

- Avoid overexposure to oil-linked currencies by diversifying your portfolio.

- Use Risk Management Tools:

- Set stop-loss orders to protect against sudden price reversals.

- Practice Patience:

- Wait for confirmation of oil price trends before entering trades.

Conclusion

Crude oil prices exert a profound influence on forex markets, shaping the value of currencies in both exporting and importing nations. By understanding these dynamics and employing effective trading strategies, forex traders can capitalize on the interplay between oil prices and currency pairs.

While trading oil-linked currencies presents opportunities, it also requires careful analysis and risk management. By staying informed and leveraging both technical and fundamental insights, traders can navigate the complexities of this relationship and achieve greater success in the forex market.