In forex trading, double top and double bottom patterns are popular reversal patterns that provide valuable insights into potential price movements. Recognizing these patterns and using them effectively can help traders identify key turning points in the market, enabling better decision-making and improving profitability.

This blog explores how to recognize and trade double-top and double-bottom patterns, covering their characteristics, formation, and practical trading strategies.

What Are Double Top and Double Bottom Patterns?

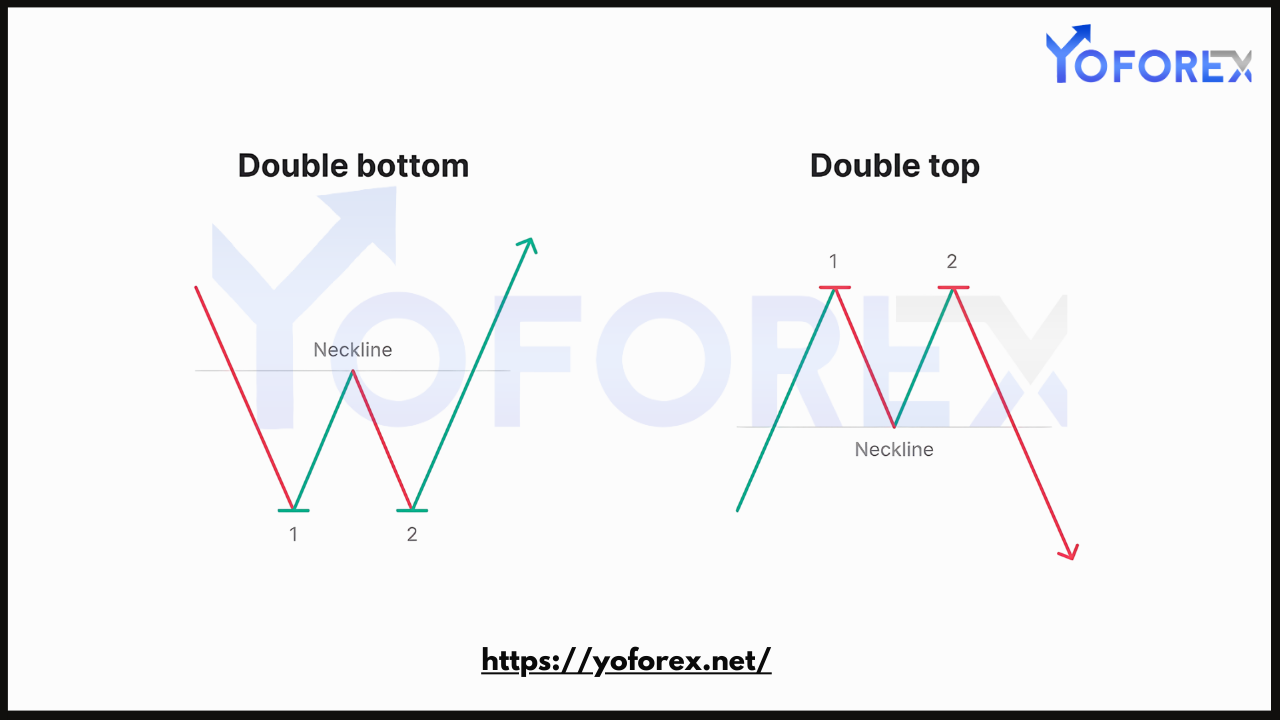

Double Top:

- A bearish reversal pattern that signals the end of an uptrend.

- It forms when the price reaches a resistance level twice but fails to break through, indicating a potential decline.

Double Bottom:

- A bullish reversal pattern that signals the end of a downtrend.

- It forms when the price reaches a support level twice but fails to break below, indicating a potential rise.

Characteristics of Double Top and Double Bottom Patterns

Key Features:

- Two Peaks or Troughs:

- Double tops have two distinct peaks, while double bottoms have two troughs.

- Neckline:

- The horizontal level connects the low points of a double top or the high points of a double bottom.

- Trend Reversal:

- Double tops reverse uptrends, and double bottoms reverse downtrends.

- Volume:

- Volume typically decreases during the formation of the pattern and spikes during the breakout.

- Symmetry:

- Ideally, the peaks or troughs should be similar in height and formation time.

How to Recognize Double Top and Double Bottom Patterns

Identifying a Double Top:

- Initial Uptrend:

- Look for an existing uptrend before the pattern forms.

- First Peak:

- The price reaches a resistance level and retraces downward.

- Second Peak:

- The price attempts to retest the resistance but fails to break it, forming the second peak.

- Neckline:

- Identify the support level connecting the two lows.

Identifying a Double Bottom:

- Initial Downtrend:

- Look for an existing downtrend before the pattern forms.

- First Trough:

- The price reaches a support level and retraces upward.

- Second Trough:

- The price attempts to retest the support but fails to break it, forming the second trough.

- Neckline:

- Identify the resistance level connecting the two highs.

Trading Strategies for Double Top and Double Bottom Patterns

Double Top Trading Strategy:

- Wait for Confirmation:

- Avoid entering trades prematurely. Confirm the pattern by waiting for a break below the neckline.

- Entry Point:

- Enter a short position when the price breaks below the neckline.

- Stop-Loss Placement:

- Place a stop-loss above the second peak to minimize risk.

- Take-Profit Target:

- Measure the height between the neckline and the peaks and project it downward from the neckline.

Double Bottom Trading Strategy:

- Wait for Confirmation:

- Confirm the pattern by waiting for a break above the neckline.

- Entry Point:

- Enter a long position when the price breaks above the neckline.

- Stop-Loss Placement:

- Place a stop-loss below the second trough to minimize risk.

- Take-Profit Target:

- Measure the height between the neckline and the troughs and project it upward from the neckline.

Combining with Technical Tools

1. Volume Analysis:

- Look for increased volume during the breakout to confirm the validity of the pattern.

2. Moving Averages:

- Use moving averages to identify the overall trend and filter false signals.

3. RSI (Relative Strength Index):

- Check for overbought or oversold conditions to validate reversal patterns.

4. Fibonacci Retracement:

- Use Fibonacci levels to identify potential support or resistance zones.

Risk Management

- Use Stop-Loss Orders:

- Protect your capital by placing stop-loss orders at strategic levels.

- Position Sizing:

- Limit your risk to 1-2% of your account balance per trade.

- Avoid Overtrading:

- Focus on high-probability setups and avoid forcing trades.

- Monitor Key Levels:

- Keep an eye on support and resistance levels to adjust your strategy as needed.

Common Mistakes to Avoid

- Ignoring Confirmation:

- Entering trades without confirming the breakout can lead to false signals.

- Forcing Patterns:

- Avoid seeing patterns where none exist; ensure clear and symmetrical formations.

- Neglecting Volume:

- Lack of volume confirmation increases the likelihood of failed breakouts.

- Overlooking Market Context:

- Consider the overall trend and fundamental factors before trading.

Practical Example

Double Top Example:

- Currency Pair: EUR/USD

- Timeframe: 4-hour chart

- Formation:

- Price forms two peaks at 1.2000 with a neckline at 1.1800.

- Entry:

- Enter a short position when the price breaks below 1.1800.

- Stop-Loss:

- Place a stop-loss at 1.2050.

- Take-Profit:

- Measure the height (200 pips) and set a target at 1.1600.

Double Bottom Example:

- Currency Pair: USD/JPY

- Timeframe: Daily chart

- Formation:

- Price forms two troughs at 110.00 with a neckline at 112.00.

- Entry:

- Enter a long position when the price breaks above 112.00.

- Stop-Loss:

- Place a stop-loss at 109.50.

- Take-Profit:

- Measure the height (200 pips) and set a target at 114.00.

Conclusion

Double top and double bottom patterns are powerful tools for identifying potential reversals in forex trading. By understanding their characteristics and using disciplined trading strategies, traders can improve their decision-making and enhance profitability. Combining these patterns with technical tools, risk management practices, and a clear trading plan will help traders maximize their success in the forex market.