Trend channels are powerful tools in forex trading that help traders identify market trends, potential reversal points, and optimal entry and exit levels. By understanding how to use trend channels effectively, traders can improve their decision-making and enhance their overall trading performance.

This blog explores the concept of trend channels, their types, benefits, and strategies for using them to identify better trade entries in the forex market.

What Are Trend Channels?

A trend channel is a charting tool that consists of two parallel lines drawn along the price action of a currency pair. These lines represent:

- Upper Boundary (Resistance):

- The line connecting successive highs during an uptrend or the top of a range-bound market.

- Lower Boundary (Support):

- The line connecting successive lows during a downtrend or the bottom of a range-bound market.

Trend channels help traders visualize the market’s direction and identify opportunities within the boundaries.

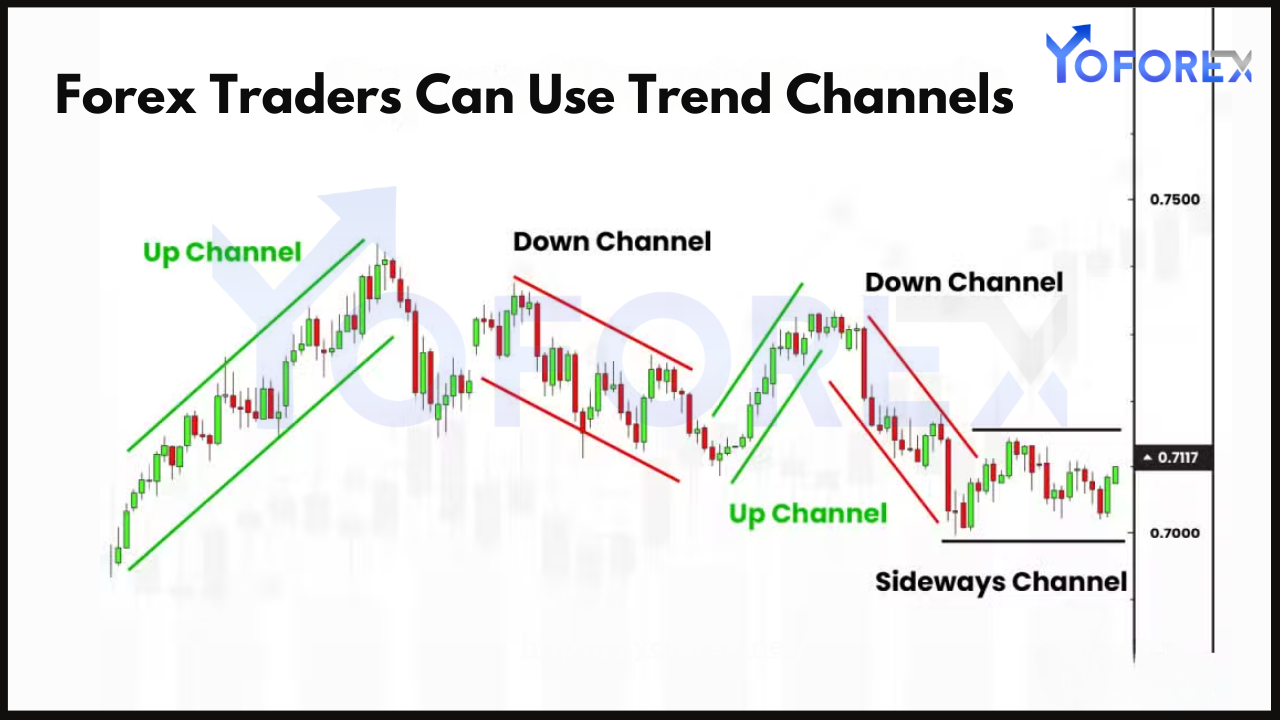

Types of Trend Channels

- Ascending Trend Channels:

- Characterized by higher highs and higher lows.

- Indicates an uptrend.

- Example: EUR/USD moving upward in response to positive economic data.

- Descending Trend Channels:

- Characterized by lower highs and lower lows.

- Indicates a downtrend.

- Example: USD/JPY declining due to geopolitical tensions.

- Horizontal Channels (Range-Bound):

- Price moves sideways within parallel lines.

- Indicates market consolidation or indecision.

- Example: GBP/USD consolidating before a major economic announcement.

Benefits of Using Trend Channels

1. Improved Trade Entries:

- Trend channels highlight potential entry points along support or resistance levels, allowing traders to buy low in an uptrend or sell high in a downtrend.

2. Risk Management:

- Clearly defined boundaries help set stop-loss levels outside the channel to minimize losses.

3. Trend Identification:

- Channels confirm the market’s direction and help traders align their positions with the prevailing trend.

4. Versatility:

- Applicable to various timeframes, making them suitable for day traders, swing traders, and long-term investors.

How to Draw Trend Channels

Step 1: Identify the Trend

- Determine whether the market is in an uptrend, downtrend, or range-bound phase.

Step 2: Draw the First Line

- For an uptrend:

- Connect two or more higher lows to form the lower boundary (support).

- For a downtrend:

- Connect two or more lower highs to form the upper boundary (resistance).

Step 3: Draw the Parallel Line

- Use the same slope as the first line to draw the parallel boundary.

Step 4: Adjust as Needed

- Ensure the channel encompasses most of the price action while excluding outliers or extreme spikes.

Strategies for Using Trend Channels

1. Trend Following

- Use trend channels to enter trades in the direction of the prevailing trend.

Setup:

- Buy: When the price bounces off the lower boundary in an ascending channel.

- Sell: When the price bounces off the upper boundary in a descending channel.

Example:

- In an ascending EUR/USD channel, enter a long position near the lower boundary with a stop-loss below the channel.

2. Counter-Trend Trading

- Trade reversals when the price breaks out of the channel.

Setup:

- Enter a short position when the price breaks below the lower boundary of an ascending channel.

- Enter a long position when the price breaks above the upper boundary of a descending channel.

Example:

- In a descending USD/JPY channel, go long after the price breaks above the upper boundary and confirms the reversal.

3. Scalping Within Channels

- Take advantage of smaller price movements within range-bound channels.

Setup:

- Buy: Near the lower boundary.

- Sell: Near the upper boundary.

Example:

- In a horizontal GBP/USD channel, place multiple trades as the price oscillates between support and resistance.

4. Combining with Indicators

- Enhance channel trading with technical indicators for confirmation.

Indicators to Use:

- RSI: Identify overbought or oversold conditions near channel boundaries.

- MACD: Confirm trend direction or divergence signals.

- Moving Averages: Identify dynamic support and resistance levels.

Example:

- Use RSI to confirm a buy signal when the price touches the lower boundary of an ascending channel.

Risk Management When Using Trend Channels

1. Set Stop-Loss Orders

- Place stop-loss orders outside the channel to protect against false breakouts.

2. Position Sizing

- Adjust trade sizes to limit risk to 1-2% of your account balance per trade.

3. Avoid Overtrading

- Stick to high-probability setups and avoid forcing trades when the market lacks clarity.

4. Monitor Breakouts

- Be prepared to exit positions if the price breaks out of the channel in the opposite direction.

Common Mistakes to Avoid

1. Ignoring Market Context

- Always consider the broader market trend and fundamental factors before trading.

2. Drawing Channels Incorrectly

- Ensure trend lines are accurate and account for most price action without overfitting.

3. Overlooking False Breakouts

- Use confirmation signals, such as volume or candlestick patterns, to validate breakouts.

4. Neglecting Risk Management

- Always use stop-loss orders and position sizing to protect against unexpected market moves.

Practical Example: Trading AUD/USD with Trend Channels

Scenario:

- Currency Pair: AUD/USD

- Trend: Uptrend on a 4-hour chart.

Steps:

- Draw the Channel:

- Connect two higher lows to form the lower boundary and draw a parallel upper boundary.

- Identify Entry Points:

- Enter a long position when the price bounces off the lower boundary at 0.7000.

- Set Risk Management Levels:

- Place a stop-loss at 0.6950 (below the channel).

- Set a take-profit target near the upper boundary at 0.7100.

- Monitor the Trade:

- Adjust stop-loss levels to lock in profits as the price moves upward.

Conclusion

Trend channels are invaluable tools for forex traders seeking better entry and exit points. By understanding their types, benefits, and practical applications, traders can align their strategies with market trends and enhance their decision-making. Combining trend channels with technical indicators, disciplined risk management, and a clear trading plan can significantly improve your forex trading outcomes.