In forex trading, technical and fundamental analysis are two primary approaches used to understand market movements and make informed decisions. While many traders favor one method over the other, combining technical and fundamental analysis can offer a more comprehensive view of the market. By leveraging the strengths of both approaches, traders can enhance their strategies and improve their chances of success.

This blog explores the principles of technical and fundamental analysis, the benefits of combining them, and practical ways to integrate these methods into your forex trading strategy.

What is Technical Analysis?

Technical analysis involves studying historical price data, charts, and trading volume to identify patterns and predict future market movements. It is based on the premise that all relevant information is already reflected in the price and that history tends to repeat itself.

Key Components of Technical Analysis:

- Charts and Price Patterns:

- Candlestick patterns, head and shoulders, double tops, and triangles.

- Indicators and Oscillators:

- Tools like Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

- Support and Resistance Levels:

- Horizontal price levels where the price tends to reverse or consolidate.

- Trend Analysis:

- Identifying bullish, bearish, or sideways trends.

What is Fundamental Analysis?

Fundamental analysis focuses on evaluating economic, financial, and geopolitical factors that influence a currency’s value. It involves studying macroeconomic indicators, central bank policies, and global events to understand market sentiment.

Key Components of Fundamental Analysis:

- Economic Indicators:

- GDP, inflation rates, employment data, and retail sales.

- Central Bank Policies:

- Interest rate decisions, quantitative easing, and forward guidance.

- Geopolitical Events:

- Elections, trade wars, and political instability.

- Market Sentiment:

- The collective mood of traders and investors based on news and economic developments.

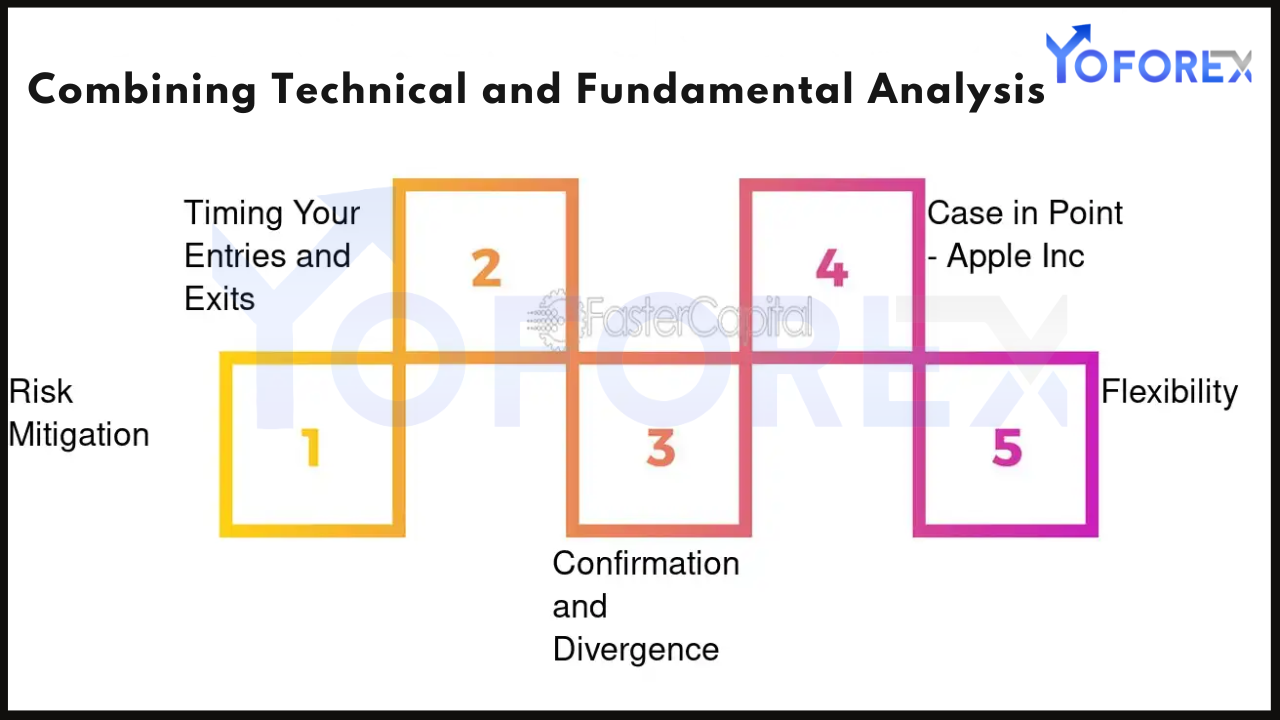

Benefits of Combining Technical and Fundamental Analysis

Combining technical and fundamental analysis provides a holistic approach to forex trading, allowing traders to:

- Enhance Decision-Making:

- Technical analysis identifies entry and exit points, while fundamental analysis explains the reasons behind price movements.

- Confirm Trends:

- Use fundamental factors to validate trends identified through technical analysis.

- Adapt to Market Conditions:

- Balance short-term price movements with long-term economic trends.

- Reduce Risks:

- A broader analysis helps avoid trades based on incomplete information.

How to Combine Technical and Fundamental Analysis

Step 1: Start with Fundamental Analysis

- Monitor Economic Calendars:

- Keep track of major events and data releases, such as Non-Farm Payrolls (NFP), Consumer Price Index (CPI), and central bank meetings.

- Analyze Macroeconomic Trends:

- Understand long-term economic factors affecting currency pairs, such as trade balances and interest rate differentials.

- Evaluate Geopolitical Events:

- Consider the impact of elections, trade agreements, and geopolitical tensions.

Step 2: Use Technical Analysis for Timing

- Identify Key Levels:

- Determine support and resistance levels to pinpoint potential entry and exit points.

- Monitor Price Patterns:

- Look for chart patterns that align with fundamental analysis, such as breakouts or reversals.

- Apply Indicators:

- Use tools like RSI or MACD to confirm the strength of trends and identify overbought or oversold conditions.

Step 3: Align Technical and Fundamental Insights

- Trend Validation:

- Confirm technical trends with fundamental factors. For example, an uptrend in EUR/USD may align with strong European economic data.

- Avoid Contradictions:

- Be cautious if technical and fundamental analyses provide conflicting signals.

- Adjust Strategies:

- Adapt trading strategies based on the alignment of technical and fundamental factors.

Example of Combining Technical and Fundamental Analysis

Scenario:

- Currency Pair: USD/JPY

- Fundamental Insight: The Federal Reserve announces a potential interest rate hike, strengthening the USD.

- Technical Insight: The USD/JPY price breaks above a key resistance level, indicating bullish momentum.

Action Plan:

- Entry Point:

- Enter a long position when the price sustains above the resistance level.

- Stop-Loss Placement:

- Set a stop-loss below the resistance level to manage risk.

- Profit Target:

- Use Fibonacci retracement levels or previous highs to set take-profit targets.

Tools for Combining Analysis

- Economic Calendars:

- Websites like Forex Factory and Investing.com provide real-time updates on economic events.

- Charting Platforms:

- Use platforms like MetaTrader, TradingView, or cTrader for advanced technical analysis.

- News Feeds:

- Stay informed with Bloomberg, Reuters, or other financial news sources.

- Correlation Analysis Tools:

- Analyze correlations between currency pairs to understand broader market dynamics.

Common Mistakes to Avoid

- Overemphasis on One Method:

- Relying too heavily on either technical or fundamental analysis can lead to incomplete strategies.

- Ignoring Market Sentiment:

- Failing to account for market sentiment can result in unexpected losses.

- Neglecting Risk Management:

- Always use stop-loss orders and position sizing to mitigate risks.

- Misinterpreting Data:

- Ensure a clear understanding of both technical indicators and fundamental data.

Practical Tips for Success

- Stay Disciplined:

- Follow your trading plan and avoid impulsive decisions based on short-term market noise.

- Backtest Strategies:

- Test combined approaches on historical data to identify strengths and weaknesses.

- Stay Updated:

- Continuously monitor economic and market developments to refine your analysis.

- Use Multiple Timeframes:

- Analyze longer timeframes for fundamental trends and shorter timeframes for technical setups.

Conclusion

Combining technical and fundamental analysis in forex trading provides a well-rounded approach to understanding market dynamics. By integrating these methods, traders can leverage the strengths of both approaches to identify opportunities, confirm trends, and manage risks effectively. While each method has its merits, its synergy can enhance trading strategies and increase the likelihood of success in the forex market.