In the fast-paced world of forex trading, gaining an edge requires a blend of strategy, precision, and adaptability. One of the most effective tools in a trader’s arsenal is multiple timeframe analysis (MTA). This technique involves examining the same currency pair across different timeframes to gain a comprehensive view of market behavior. By using multiple timeframe analyses, traders can make more informed decisions, align their trades with broader trends, and improve their overall profitability.

What is Multiple Timeframe Analysis?

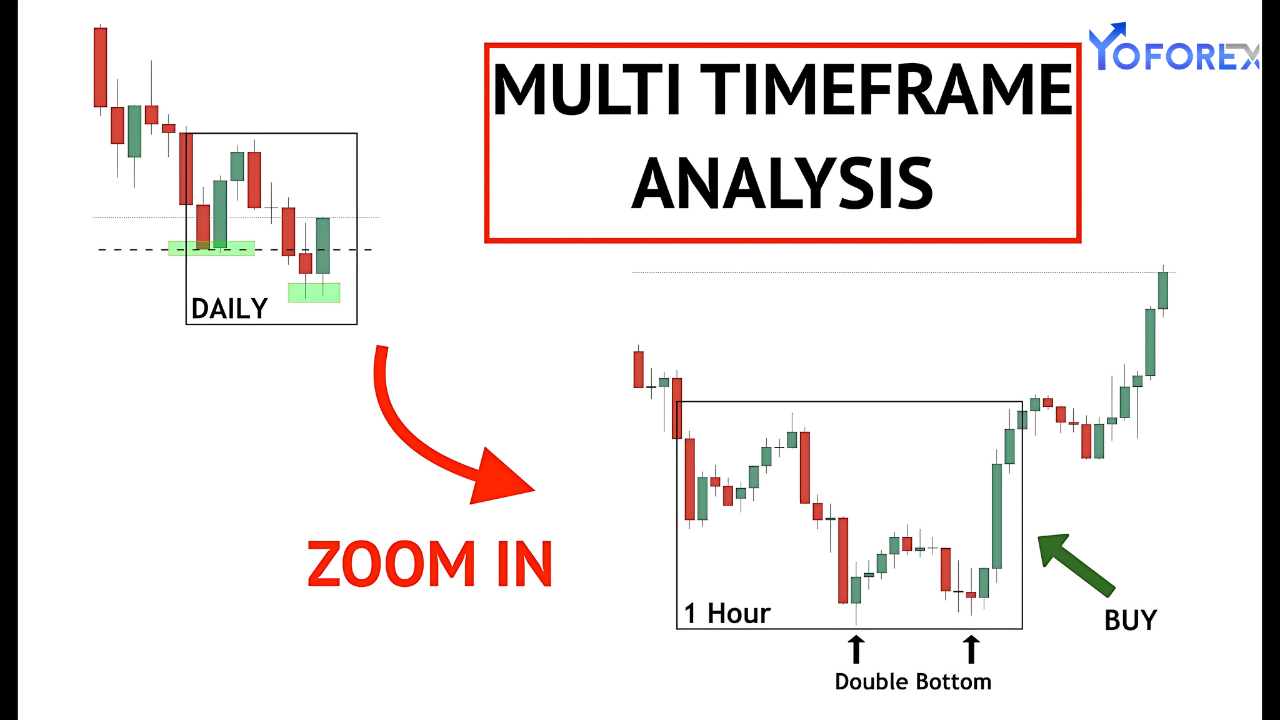

Multiple timeframe analysis is the process of analyzing a forex pair’s price action on at least two or more timeframes. Traders typically use three timeframes:

- Higher Timeframe (Long-Term): This provides an overview of the major trend and overall market direction. Examples include daily (D1), weekly (W1), or monthly (MN) charts.

- Intermediate Timeframe (Medium-Term): This bridges the gap between long-term and short-term trends, helping traders identify consolidation or correction phases. Examples include 4-hour (H4) or 1-hour (H1) charts.

- Lower Timeframe (Short-Term): This is used for precise trade entries and exits. Examples include 15-minute (M15) or 5-minute (M5) charts.

Why Use Multiple Timeframes?

Analyzing only one timeframe can lead to incomplete or misleading conclusions. For instance, a trader might spot a buy signal on a 15-minute chart, only to realize that it contradicts the dominant downtrend visible on the daily chart. Multiple timeframe analysis helps traders:

- Understand the Bigger Picture:

- The higher timeframe reveals the overall trend, allowing traders to align their trades with the market’s direction.

- Spot Opportunities:

- The intermediate timeframe highlights potential setups within the broader trend, such as pullbacks or breakouts.

- Refine Entry and Exit Points:

- The lower timeframe provides the precision needed to execute trades at optimal levels.

- Reduce Risk:

- By aligning trades with the broader trend, traders minimize the risk of countertrend moves.

How to Perform Multiple Timeframe Analysis

Here’s a step-by-step approach to implementing MTA in your trading routine:

1. Choose Your Primary Timeframe

- Determine your trading style and select a primary timeframe that suits your strategy:

- Scalpers: Focus on 1-minute (M1) or 5-minute (M5) charts.

- Day Traders: Use 15-minute (M15) or 1-hour (H1) charts.

- Swing Traders: Analyze daily (D1) or weekly (W1) charts.

2. Add Higher and Lower Timeframes

- Select a higher timeframe to identify the dominant trend and a lower timeframe for precise entries and exits. For example, a day trader might use H4 (higher), H1 (primary), and M15 (lower) charts.

3. Analyze the Higher Timeframe

- Start by identifying the overall trend (uptrend, downtrend, or sideways) and key support and resistance levels. Use technical indicators like moving averages or trendlines to confirm the trend.

4. Examine the Intermediate Timeframe

- Look for patterns or consolidation zones that indicate potential setups. This timeframe helps refine your understanding of market structure within the broader trend.

5. Drill Down to the Lower Timeframe

- Use the lower timeframe to pinpoint trade entries, exits, and stop-loss placements. This is where you can apply techniques like candlestick patterns or oscillator signals for precision.

Example of Multiple Timeframe Analysis in Action

Let’s consider a trader analyzing the EUR/USD pair:

- Higher Timeframe (Daily):

- The daily chart shows a strong uptrend with the price above the 200-day moving average.

- Key resistance is identified at 1.1200, while support is at 1.1000.

- Intermediate Timeframe (4-Hour):

- The H4 chart shows a pullback to the 50-period moving average, suggesting a buying opportunity within the uptrend.

- Lower Timeframe (15-Minute):

- The M15 chart reveals a bullish engulfing candlestick pattern near the 50-period moving average, confirming the buy setup.

The trader places a long position at the identified level with a stop-loss below the recent low on the M15 chart and a target near the resistance level on the daily chart.

Benefits of Multiple Timeframe Analysis

- Improved Accuracy:

- Combining timeframes reduces the likelihood of false signals and improves decision-making.

- Adaptability:

- Traders can adapt to changing market conditions by observing trends across different timeframes.

- Enhanced Confidence:

- Aligning signals from multiple timeframes provides greater confidence in trade setups.

- Better Risk-Reward Ratio:

- By timing entries precisely on the lower timeframe, traders can achieve a more favorable risk-reward ratio.

Common Mistakes in Multiple Timeframe Analysis

- Overcomplicating the Process:

- Using too many timeframes can lead to analysis paralysis. Stick to three timeframes for clarity.

- Ignoring the Higher Timeframe:

- Neglecting the dominant trend often results in countertrend trades with lower probabilities of success.

- Failing to Align Timeframes:

- Ensure that your analysis across timeframes aligns; conflicting signals can lead to poor trades.

- Chasing Signals:

- Avoid taking trades based solely on the lower timeframe without considering the broader market context.

Tools to Enhance Multiple Timeframe Analysis

- Charting Platforms:

- Use platforms like MetaTrader, TradingView, or NinjaTrader to switch seamlessly between timeframes.

- Technical Indicators:

- Moving averages, Fibonacci retracements, and trendlines work well across multiple timeframes.

- Price Action:

- Candlestick patterns and chart formations provide valuable insights into market behavior.

Conclusion

Multiple timeframe analysis is a powerful method that equips forex traders with a well-rounded perspective of market dynamics. By examining the same currency pair across different timeframes, traders can identify high-probability setups, refine their strategies, and reduce the risk of unfavorable trades. Whether you are a beginner or an experienced trader, incorporating multiple timeframe analyses into your trading routine can significantly enhance your ability to navigate the forex market with confidence and precision.

Understanding how timeframes interact allows traders to make better-informed decisions, trade with the trend, and optimize their entry and exit points. By mastering MTA, traders can turn potential challenges into profitable opportunities in the ever-changing forex market.