The financial markets are complex and unpredictable, and even the most experienced traders are prone to psychological biases that can undermine their success. One of the most prevalent biases is the disposition effect, a tendency where traders hold onto losing positions for too long while selling winning ones prematurely. This behavior stems from a combination of fear, hope, and cognitive distortions, often resulting in suboptimal outcomes. In this blog, we’ll dive deep into the disposition effect and explore actionable strategies to avoid it.

Understanding the Disposition Effect

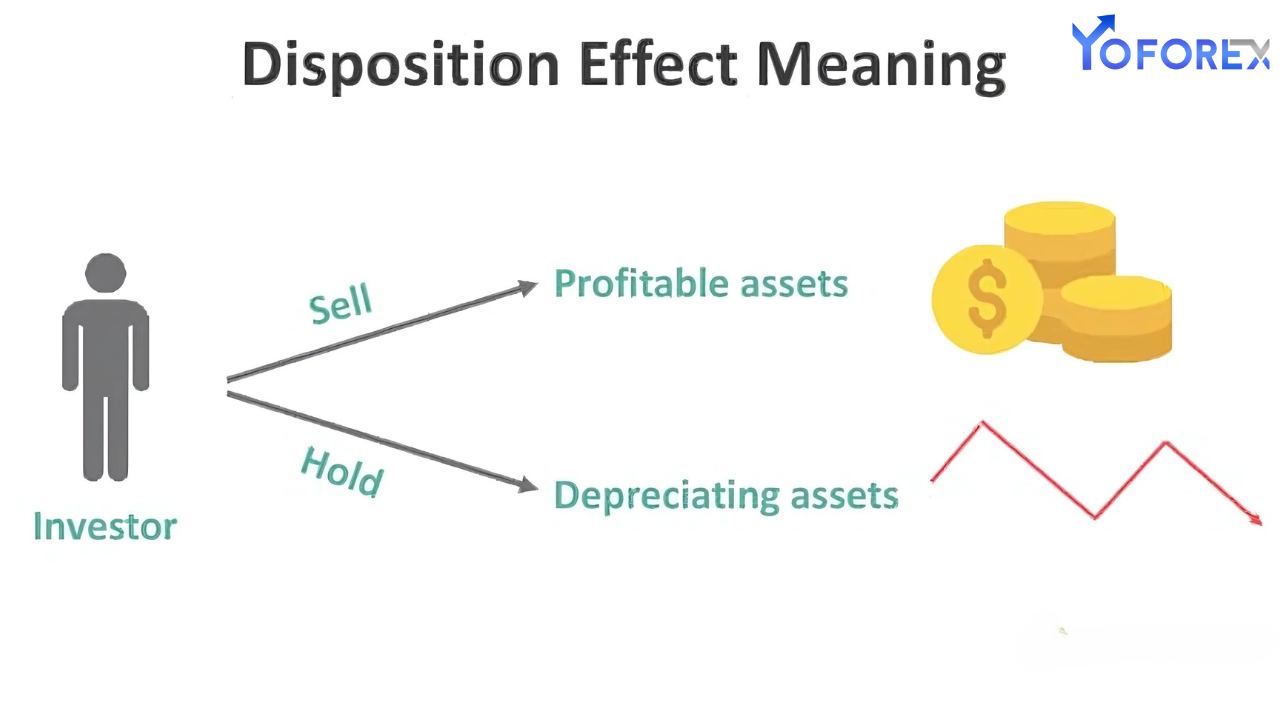

The disposition effect, first identified by Shefrin and Statman in 1985, is a behavioral finance concept that describes traders’ tendencies to:

- Sell winners too quickly: Locking in small realized gains out of fear that profits might evaporate.

- Hold losers too long: Clinging to the hope that losing positions will recover, avoiding the pain of realizing a loss.

This behavior often leads to poor portfolio performance, as traders miss opportunities for further gains while enduring unnecessary losses. The psychological drivers behind the disposition effect include:

- Loss aversion: People feel the pain of losses more acutely than the pleasure of gains.

- Prospect theory: Decisions are influenced by perceived gains or losses relative to a reference point, rather than absolute outcomes.

- Overconfidence: Believing in the ability to predict market reversals leads to holding onto losing trades.

Why the Disposition Effect Is Harmful

The disposition effect is detrimental for several reasons:

- Missed Opportunities: Selling winners prematurely prevents traders from capitalizing on long-term upward trends.

- Capital Misallocation: Holding losing positions ties up capital that could be invested in more profitable opportunities.

- Emotional Stress: Hoping for rebounds in losing trades can cause anxiety and irrational decision-making.

Avoiding the disposition effect is critical for achieving consistent and sustainable trading success.

Strategies to Avoid the Disposition Effect

Below are practical strategies to help traders overcome the disposition effect and make more rational decisions:

1. Establish Clear Trading Rules

Creating predefined rules helps eliminate emotional decision-making. Examples include:

- Profit Targets: Set specific levels at which you will take profits to avoid exiting trades too early.

- Stop-Loss Orders: Predetermine the price at which you will exit losing trades, limiting losses.

Tip: Stick to these rules consistently, even during periods of heightened market volatility.

2. Adopt a Long-Term Perspective

Traders who focus on short-term price movements are more vulnerable to the disposition effect. Shifting to a long-term mindset helps:

- Reduce the urge to react to daily price fluctuations.

- View individual trades as part of a broader, strategic portfolio.

Tip: Study historical price trends to build confidence in holding winning positions longer.

3. Use Data-Driven Analysis

Basing decisions on objective data rather than emotions can mitigate cognitive biases. Consider using:

- Technical Analysis: Identify trends, support, and resistance levels to inform decisions.

- Fundamental Analysis: Evaluate the underlying value of assets to determine whether holding or selling makes sense.

- Trading Journals: Record the rationale behind each trade to track patterns and improve decision-making over time.

Tip: Leverage tools like trading platforms and analytics software for real-time insights.

4. Reframe Losses as Learning Opportunities

Accepting that losses are part of trading is crucial to overcoming the fear of realizing them. Strategies include:

- Post-Trade Analysis: Review losing trades to identify mistakes and learn from them.

- Set a Loss Limit: Predetermine how much you are willing to lose on a single trade, ensuring that losses remain manageable.

Tip: Treat losses as a cost of doing business rather than personal failures.

5. Diversify Your Portfolio

Diversification reduces reliance on individual trades and minimizes emotional attachment to any single position. A diversified portfolio might include:

- Assets from different sectors or industries.

- A mix of asset classes, such as equities, commodities, and cryptocurrencies.

Tip: Use diversification to spread risk and maintain a balanced approach to trading.

6. Practice Emotional Awareness

Recognizing your emotional triggers can help you avoid impulsive decisions. Strategies to enhance emotional awareness include:

- Mindfulness Meditation: Stay present and reduce stress during volatile market conditions.

- Emotional Journaling: Track your feelings during trades to identify patterns.

Tip: Develop routines to maintain focus and reduce the impact of emotions on your trading decisions.

7. Focus on Risk-Reward Ratios

Rather than fixating on gains or losses, evaluate trades based on their risk-reward ratio. This approach shifts your focus from emotional outcomes to logical assessments.

- Set Minimum Ratios: For example, only take trades with a risk-reward ratio of 1:2 or higher.

- Reassess Regularly: Ensure that your current positions still meet your risk-reward criteria.

Tip: Use risk-reward ratios as a cornerstone of your trading strategy.

8. Leverage Technology and Automation

Automated trading systems can execute trades based on predefined criteria, reducing the influence of emotions. Consider:

- Trading Bots: Use bots to automate entries and exits based on technical indicators.

- Alerts and Notifications: Set up alerts for key price levels to stay informed without constant monitoring.

Tip: Choose automation tools that align with your trading goals and strategies.

9. Engage with Mentors and Communities

Learning from experienced traders and participating in trading communities can provide fresh perspectives and accountability. Benefits include:

- Objective Feedback: Mentors can identify biases in your decision-making process.

- Shared Experiences: Communities offer support and insights from traders facing similar challenges.

Tip: Seek out reputable forums, groups, or mentorship programs to expand your network.

10. Monitor and Evaluate Your Performance

Regularly reviewing your trading performance helps you identify and address behavioral patterns. Use a trading journal to:

- Document entry and exit points, along with the rationale for each trade.

- Analyze outcomes to determine whether the disposition effect influenced your decisions.

Tip: Treat self-assessment as an ongoing process for continuous improvement.

Conclusion

The disposition effect is a common psychological bias that can hinder trading success, but it’s not insurmountable. By implementing strategies such as setting clear rules, embracing data-driven decision-making, and practicing emotional awareness, traders can overcome this bias and achieve better outcomes. Remember, successful trading requires not just technical expertise but also the discipline to manage your mindset effectively. With the right approach, you can navigate the markets with confidence and consistency.