The forex market is vast and complex, with trillions of dollars traded daily. Institutional players such as banks, hedge funds, and large corporations wield significant influence on market direction. These institutions can cause substantial market moves that retail traders often find difficult to anticipate. However, by utilizing order flow analysis, traders can gain insight into the actions of these large players and increase the likelihood of making profitable trades. In this blog post, we’ll delve into the concept of order flow analysis and how it can be used to spot institutional forex moves.

What is Order Flow Analysis?

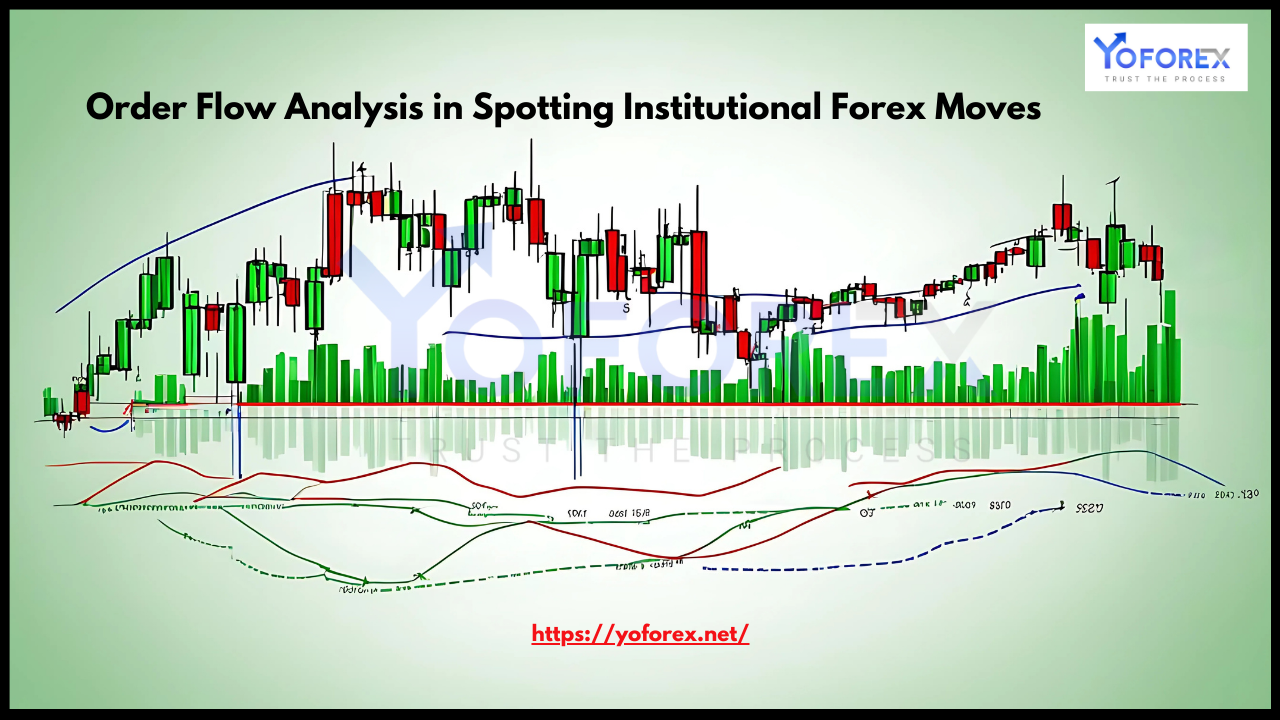

Order flow analysis refers to the study of the buy and sell orders in the market, tracking the flow of trades and understanding how they impact price movements. Rather than focusing solely on historical price patterns, order flow analysis examines the underlying market mechanics that drive price action.

In a typical forex market, when an order is placed, it gets matched against existing orders in the order book. These trades are executed based on the price levels of buy and sell orders. By studying how these orders interact with the market, traders can gauge where institutional players are positioning themselves and where significant price moves are likely to occur.

While retail traders often use technical indicators, order flow analysis offers a more direct and immediate look at the market’s liquidity and the intentions of large traders. This approach can be particularly useful for spotting institutional moves, which are often a precursor to significant trends in the market.

Understanding Institutional Moves

Institutional players are responsible for the bulk of forex trading volume. Unlike retail traders who may place smaller trades, institutions deal in enormous quantities of currency, which means their actions can have a major impact on price movements.

Institutional traders typically have access to sophisticated tools, more resources, and deeper market insights. As a result, their trading decisions are often based on thorough analysis, to enter and exit the market at the most opportune times. These large players generally seek liquidity to fill their massive orders and use sophisticated strategies to avoid market slippage.

There are several ways institutions influence the forex market:

- Market Sentiment: Institutions are capable of shifting the sentiment in the market. Their trades can signal strong buy or sell pressure, often resulting in sudden and sharp price movements.

- Order Flow Dynamics: The buying or selling pressure they generate creates liquidity imbalances that can lead to large price moves.

- Economic Data and News: Institutions often react to key economic events, such as central bank decisions, economic reports, and geopolitical news, which can create market volatility.

By understanding how order flow works and tracking the orders placed by large institutions, retail traders can anticipate these movements and position themselves to capitalize on them.

Tools for Order Flow Analysis

To effectively track order flow in the forex market, traders use several tools and indicators that help them visualize the market’s liquidity and market depth. Some of the most commonly used tools include:

- Order Book Data: The order book displays the open buy and sell orders in the market. By analyzing the order book, traders can gauge where the bulk of the market’s liquidity lies and identify key price levels where institutional players are placing orders.

- Level 2 Market Data: Level 2 data shows the depth of the order book, displaying both market orders (instantaneous buys and sells) and limit orders (pending buy and sell orders). By monitoring this data, traders can identify where large institutional orders are being placed and look for potential areas of support or resistance.

- Volume Profile: This tool allows traders to visualize the volume of trades at various price levels over a specific period. Volume profile can help identify areas where significant order flow has occurred, signaling the presence of institutional trading activity.

- Footprint Charts: Footprint charts provide a detailed breakdown of the number of buy and sell orders at each price level for a given time frame. This can offer a clear view of the market’s order flow, showing whether buying or selling pressure is dominating.

- Cumulative Delta: This indicator tracks the difference between buy and sell orders, allowing traders to spot trends in market sentiment and potential institutional involvement. When the cumulative delta shows a large positive or negative value, it often indicates the presence of large institutional traders making significant moves.

- Market Profile: A market profile plots the distribution of price over a specific period, helping traders identify key areas of value and interest for institutional traders. These areas are often seen as potential reversal points or price consolidation zones.

Spotting Institutional Forex Moves

By studying order flow and using the tools mentioned above, retail traders can spot institutional forex moves before they happen. Here’s how to do it:

- Look for Liquidity Imbalances: When institutions enter the market, they typically do so in large sizes. This creates a liquidity imbalance, where the buying or selling pressure is higher than usual. These imbalances often lead to rapid price changes as the market adjusts to accommodate the large orders.Example: If a large bank places a significant buy order for a currency pair, it will create a shortage of liquidity on the sell side. As a result, the price will rise until new sellers step in to meet the demand.

- Monitor Volume and Market Depth: Pay attention to volume spikes and market depth in order flow charts. If you notice a sudden increase in volume at a particular price level, it could indicate the presence of institutional buying or selling. Additionally, large orders in the order book can serve as an early warning sign that an institutional move is underway.

- Watch for Price Reversals at Key Levels: Institutions often focus on key technical levels like support, resistance, and psychological price levels. When price reaches these levels, large institutions may place buy or sell orders in anticipation of a price reversal. Spotting these levels and watching for order flow changes can help traders position themselves for potential reversals.

- Identify Institutional Patterns: Institutional traders often exhibit certain patterns in their order flow. For example, they may enter the market gradually to avoid causing a sudden price spike, or they may use limit orders to test the market’s reaction at key price levels. By studying these patterns, traders can gain insights into the strategies employed by institutional players and align their trades accordingly.

- Follow Economic News: Economic data releases and central bank announcements often attract the attention of institutional traders. These events can lead to significant market moves, and order flow analysis can help traders spot when institutions are positioning themselves ahead of important news. Pay attention to the timing of these events and look for clues in the order book as the market begins to react.

Conclusion

Order flow analysis is a powerful tool for spotting institutional forex moves and gaining an edge in the market. By understanding how large players position themselves and tracking the flow of orders, traders can identify potential price moves before they occur. While order flow analysis may require more advanced tools and a deep understanding of market mechanics, it offers a unique perspective on the market that can be incredibly valuable for those looking to stay ahead of the curve. Whether you’re a novice trader or a seasoned professional, incorporating order flow analysis into your trading strategy can improve your ability to spot institutional moves and ultimately boost your trading performance.