In the fast-paced world of forex trading, emotions often play a significant role in decision-making. One of the most common and detrimental emotions traders face is FOMO—the “Fear of Missing Out.” This psychological phenomenon can lead to impulsive decisions, overtrading, and significant losses. In this blog, we delve into the psychology of FOMO in forex trading, its impact on performance, and actionable strategies to overcome it.

Understanding FOMO in Forex Trading

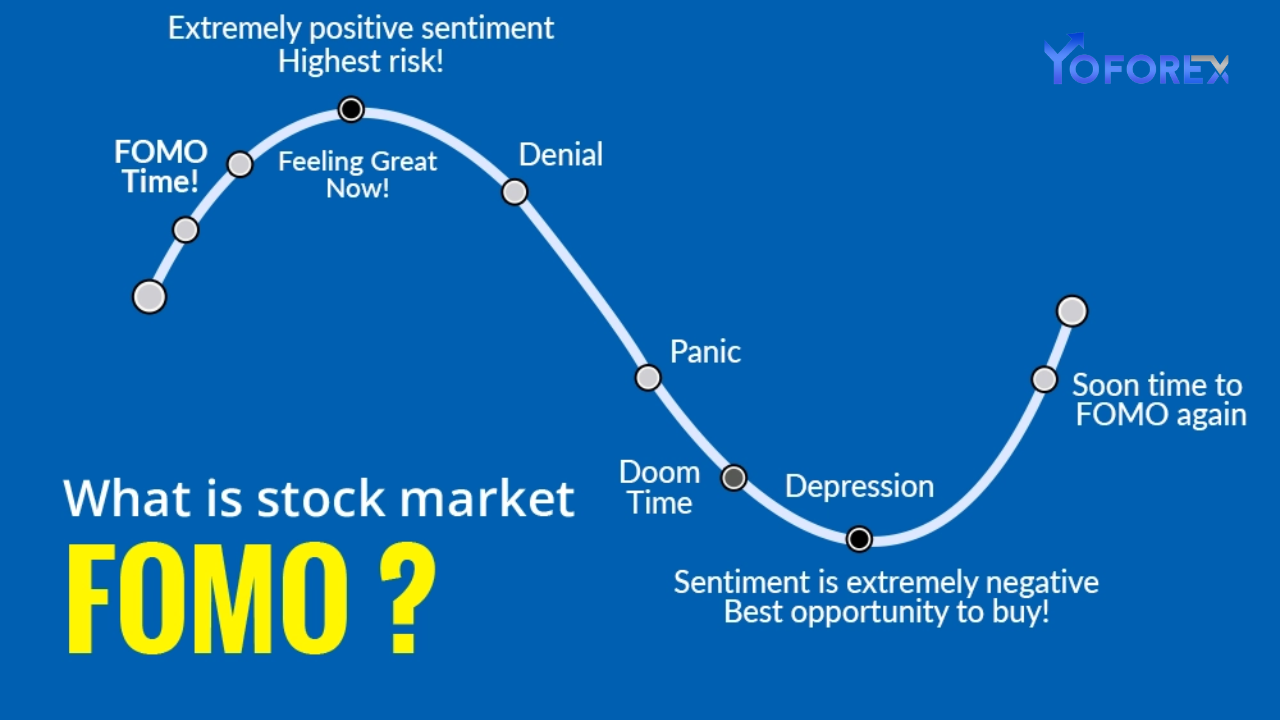

FOMO is the fear of missing out on a potentially lucrative trading opportunity. It occurs when traders feel pressured to act quickly to capitalize on market movements, often without proper analysis or planning.

Common Triggers of FOMO:

- Sudden Price Movements: Rapid price increases or decreases create a sense of urgency to jump into a trade.

- Social Media and News: Hype from influencers, news articles, or forums can amplify FOMO.

- Comparison with Other Traders: Seeing others post profits can make traders feel like they’re missing out.

- Previous Missed Opportunities: Remembering past trades that could have been profitable fuels the fear of repeating the same mistake.

The Impact of FOMO on Forex Trading

FOMO can lead to a series of poor trading behaviors that negatively affect performance and account balance. Here are some of the most common consequences:

1. Impulsive Trading

Traders driven by FOMO often enter trades without thorough analysis, relying on emotions rather than strategy.

Example: A trader enters a long position on EUR/USD because they see it surging, only to get caught in a market reversal.

2. Overtrading

The fear of missing out can lead to excessive trading, increasing transaction costs and exposing the account to unnecessary risks.

3. Inconsistent Strategy

FOMO encourages traders to abandon their trading plans, leading to inconsistent decision-making.

4. Increased Stress and Anxiety

Chasing trades out of fear can result in heightened stress, making it harder to focus and follow a disciplined approach.

How to Identify FOMO in Your Trading

Recognizing the signs of FOMO is the first step toward overcoming it. Here are some indicators:

- Constantly Checking the Market: Feeling the need to monitor charts excessively for fear of missing a move.

- Entering Trades Without a Plan: Taking positions based on gut feelings rather than technical or fundamental analysis.

- Regret Over Missed Trades: Dwelling on past opportunities instead of focusing on future ones.

- Emotional Reactions to Social Media: Feeling pressured by others’ success stories or market predictions.

Strategies to Overcome FOMO

Overcoming FOMO requires a combination of psychological discipline and practical trading techniques. Here are some effective strategies:

1. Develop and Stick to a Trading Plan

- Why It Works: A well-defined trading plan reduces impulsive decisions by outlining specific entry, exit, and risk management rules.

- How to Do It:

- Set clear criteria for entering and exiting trades.

- Use a checklist before placing any order to ensure it aligns with your strategy.

2. Focus on Risk Management

- Why It Works: Knowing your risk limits creates a buffer against emotional decision-making.

- How to Do It:

- Use stop-loss and take-profit orders for every trade.

- Risk only a small percentage of your account (e.g., 1-2%) per trade.

3. Practice Mindfulness and Emotional Awareness

- Why It Works: Mindfulness helps you stay present and avoid reacting impulsively to market movements.

- How to Do It:

- Take deep breaths or short breaks when you feel the urge to act on FOMO.

- Reflect on your emotions and question whether they align with your trading plan.

4. Limit Social Media Exposure

- Why It Works: Reducing exposure to hype and comparisons can prevent unnecessary pressure.

- How to Do It:

- Follow only credible sources of information.

- Set specific times to check news and social media.

5. Learn from Missed Opportunities

- Why It Works: Viewing missed trades as learning experiences reduces the emotional impact.

- How to Do It:

- Analyze missed trades objectively to understand what you could do differently next time.

- Keep a trading journal to track lessons learned.

6. Use Demo Trading to Build Confidence

- Why It Works: Practicing in a risk-free environment helps build discipline and reduce the fear of missing out.

- How to Do It:

- Trade in a demo account using the same strategies you plan to use in live trading.

- Focus on process-oriented goals, such as following your plan, rather than profits.

7. Set Realistic Expectations

- Why It Works: Accepting that not every trade will be profitable helps you focus on the bigger picture.

- How to Do It:

- Aim for consistent, steady growth rather than chasing quick profits.

- Remind yourself that the market is full of opportunities, and missing one isn’t the end of the world.

Case Study: Overcoming FOMO in Action

Trader Scenario: John is a forex trader who often feels pressured to jump into trades when he sees EUR/USD making significant moves. Recently, he entered a trade impulsively during a sharp price increase, only to see the market reverse, resulting in a loss.

Steps John Took to Overcome FOMO:

- Created a structured trading plan with defined entry and exit criteria.

- Limited his trading to high-probability setups that matched his plan.

- Reduced his exposure to social media by following only professional analysts.

- Started journaling his trades to identify patterns in emotional decision-making.

Outcome: John’s trading became more disciplined, and his performance improved as he focused on consistent execution rather than chasing the market.

Long-Term Benefits of Conquering FOMO

Overcoming FOMO not only improves your trading performance but also helps you develop qualities essential for long-term success:

- Discipline: Following your plan ensures consistent results.

- Confidence: Making decisions based on analysis rather than emotions builds trust in your abilities.

- Emotional Resilience: Reducing stress and anxiety allows you to approach trading with a clear mind.

- Profitability: Avoiding impulsive trades and focusing on high-quality setups enhances your bottom line.

Conclusion

FOMO is a common psychological challenge for forex traders, but it doesn’t have to control your trading decisions. By understanding its triggers, recognizing its impact, and implementing strategies to manage it, you can trade with greater discipline and confidence. Remember, successful trading is a marathon, not a sprint—opportunities are always around the corner, and staying grounded is key to long-term success.