Forex scalping is a popular trading strategy that focuses on making small, frequent profits over short timeframes. Unlike long-term trading strategies that rely on large market moves, scalping takes advantage of minute price fluctuations. While it may seem straightforward, successful scalping is rooted in a combination of scientific principles, technical analysis, and disciplined execution. This blog delves into the science behind forex scalping strategies and how traders can leverage them for success.

What is Forex Scalping?

Forex scalping involves opening and closing multiple trades within short timeframes, often seconds to minutes. The goal is to capture small price movements and accumulate profits over time. Scalpers aim for high-frequency trades with tight stop-loss and take-profit levels.

Key Characteristics:

- Short Holding Periods: Trades last from a few seconds to a few minutes.

- High Trade Volume: Scalpers execute dozens or even hundreds of trades per day.

- Low Risk Per Trade: Tight stop-loss levels minimize losses.

- Focus on Liquidity: Scalping is typically done on highly liquid currency pairs like EUR/USD, USD/JPY, or GBP/USD.

The Science Behind Forex Scalping

1. Market Microstructure

The forex market operates through a decentralized network of banks, brokers, and traders. Understanding its microstructure is crucial for scalping:

- Order Flow Dynamics: Scalpers analyze the flow of buy and sell orders to anticipate short-term price movements.

- Bid-Ask Spread: Scalpers aim to profit from price changes within the spread. Tight spreads are essential for maximizing profitability.

Example: A scalper trading EUR/USD focuses on moments of high liquidity, such as during overlapping market sessions, to take advantage of tight spreads and quick executions.

2. Technical Analysis and Indicators

Technical analysis forms the backbone of forex scalping strategies. Scalpers rely on specific indicators to identify entry and exit points.

Popular Indicators for Scalping:

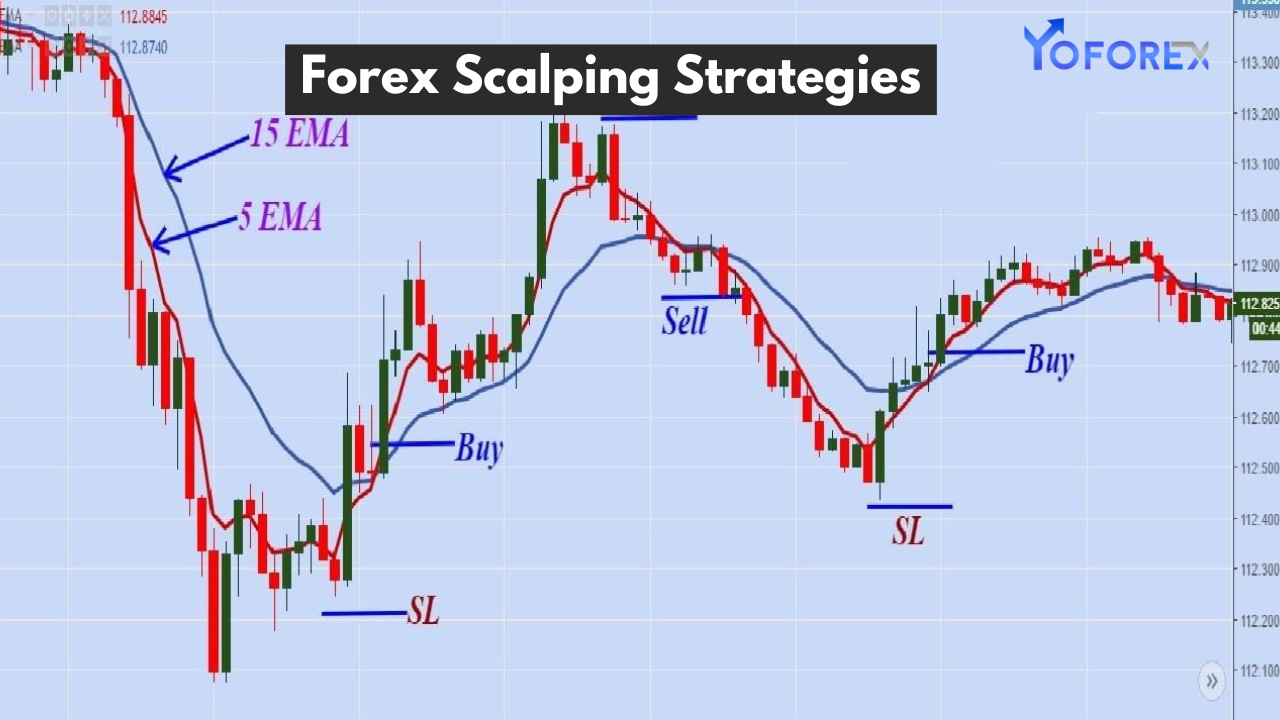

- Moving Averages (MAs):

- Used to identify short-term trends.

- Example: A scalper uses the crossover of the 5-period and 15-period MAs as a buy/sell signal.

- Bollinger Bands:

- Helps identify overbought and oversold conditions.

- Example: A scalper places trades when the price touches the upper or lower band and shows signs of reversal.

- Relative Strength Index (RSI):

- Indicates momentum and overbought/oversold levels.

- Example: A reading below 30 (oversold) triggers a buy, while above 70 (overbought) signals a sell.

- Stochastic Oscillator:

- Measures momentum and potential price reversals.

- Example: A scalper looks for crossovers in the stochastic lines to determine entry points.

Tip: Scalpers often combine multiple indicators to confirm signals and improve accuracy.

3. Timing and Volatility

Scalping thrives in volatile market conditions, where price movements are frequent and significant enough to generate profits.

Key Timing Considerations:

- Market Sessions:

- Scalping during overlapping market sessions (e.g., London and New York) ensures high liquidity and volatility.

- Economic News Releases:

- Major news events, such as interest rate decisions or employment reports, create volatility. Scalpers capitalize on these price swings.

- Timeframes:

- Scalpers use ultra-short timeframes, such as 1-minute or 5-minute charts, to analyze and execute trades.

Tip: Avoid scalping during low-liquidity periods, such as weekends or public holidays, to minimize slippage and execution delays.

4. Risk Management and Position Sizing

Effective risk management is critical for scalpers due to the high frequency of trades. Small losses can add up quickly if not controlled.

Key Risk Management Principles:

- Risk-Reward Ratio:

- Scalpers typically aim for a risk-reward ratio of at least 1:1. Even small profits can accumulate over multiple trades.

- Stop-Loss Orders:

- Tight stop-loss levels minimize exposure to unfavorable price movements.

- Position Sizing:

- Scalpers risk a small percentage of their capital on each trade (e.g., 1-2%).

- Leverage:

- While leverage amplifies profits, it also magnifies losses. Scalpers use leverage cautiously to avoid significant drawdowns.

Example: A scalper trading with $10,000 risks 1% ($100) per trade. With a 1:1 risk-reward ratio, they aim to gain $100 per trade.

Tools and Technology for Scalping

Technology plays a vital role in the success of scalping strategies. Traders rely on advanced tools for precision and efficiency.

Key Tools:

- Trading Platforms:

- Platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader offer fast execution, customizable indicators, and automated trading options.

- High-Speed Internet:

- Scalping requires fast and reliable internet connections to avoid delays in order execution.

- Automated Trading Systems:

- Expert Advisors (EAs) automate scalping strategies based on predefined criteria.

- Direct Market Access (DMA):

- DMA provides faster execution and access to real-time order books, critical for scalping.

Tip: Use a VPS (Virtual Private Server) to ensure uninterrupted trading, especially for automated systems.

Psychological Discipline in Scalping

Scalping requires a unique mindset. Emotional control and discipline are essential for consistent performance.

Common Psychological Challenges:

- Fear of Missing Out (FOMO):

- Scalpers may be tempted to enter trades impulsively. Patience is crucial for waiting for high-probability setups.

- Handling Losses:

- Accepting small, frequent losses is part of scalping. Traders must avoid revenge trading.

- Focus and Concentration:

- Scalping demands intense focus for extended periods. Fatigue can lead to errors.

Tip: Take regular breaks to maintain focus and develop a routine to manage stress.

Pros and Cons of Forex Scalping

Advantages:

- Quick Profits:

- Scalpers can accumulate profits rapidly in volatile markets.

- High Trade Frequency:

- Multiple opportunities to trade throughout the day.

- Reduced Exposure:

- Short holding periods minimize exposure to market risks.

Disadvantages:

- High Transaction Costs:

- Frequent trades result in higher spreads and commissions.

- Time-Intensive:

- Scalping requires constant monitoring and active participation.

- Psychological Stress:

- The fast-paced nature of scalping can be mentally exhausting.

Conclusion

Forex scalping is a sophisticated strategy that combines market microstructure, technical analysis, and disciplined execution. While it offers opportunities for quick profits, it also demands a high level of skill, focus, and risk management. By understanding the science behind scalping and leveraging the right tools and techniques, traders can improve their chances of success in this fast-paced trading style. As with any strategy, practice, and persistence are key to mastering forex scalping.