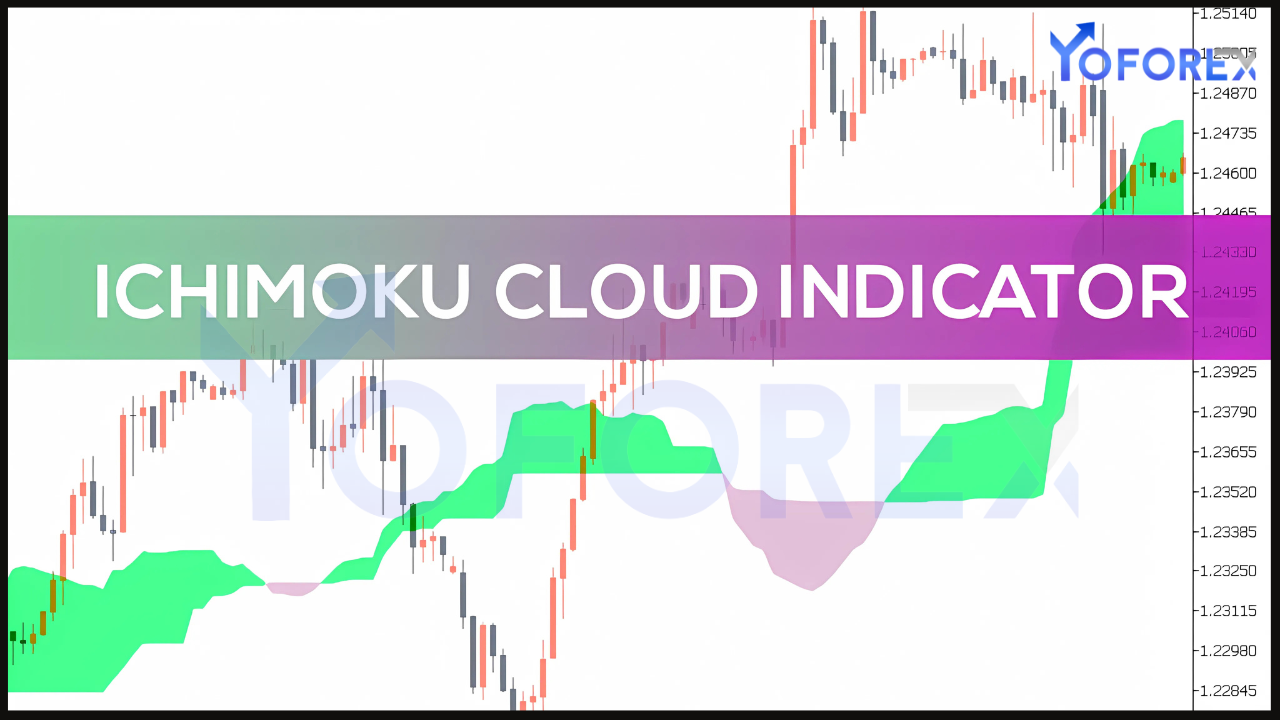

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is a versatile and comprehensive technical analysis tool that provides a holistic view of market trends, momentum, and potential support and resistance levels. Widely used by forex traders, this indicator is particularly valuable for identifying high-probability trading opportunities. Although it may seem complex at first glance, understanding how to use the Ichimoku Cloud effectively can significantly enhance your forex trading strategy.

This blog delves into the components of the Ichimoku Cloud, how it works, and actionable strategies for trading forex using this powerful indicator.

What is the Ichimoku Cloud?

The Ichimoku Cloud was developed by Goichi Hosoda, a Japanese journalist, in the 1930s and introduced publicly in the late 1960s. The name “Ichimoku Kinko Hyo” translates to “one look equilibrium chart,” highlighting its ability to provide a complete market view at a glance.

Components of the Ichimoku Cloud

- Tenkan-sen (Conversion Line):

- Calculated as the average of the highest high and lowest low over the past 9 periods.

- Signals short-term momentum and potential reversals.

- Kijun-sen (Base Line):

- Calculated as the average of the highest high and lowest low over the past 26 periods.

- Acts as a medium-term trend indicator and support/resistance level.

- Senkou Span A (Leading Span A):

- The average of the Tenkan-sen and Kijun-sen, plotted 26 periods ahead.

- Forms one edge of the cloud.

- Senkou Span B (Leading Span B):

- The average of the highest high and lowest low over the past 52 periods, plotted 26 periods ahead.

- Forms the other edge of the cloud.

- Chikou Span (Lagging Span):

- The current closing price plotted 26 periods behind.

- Provides additional confirmation of trends.

- Kumo (Cloud):

- The area between Senkou Span A and Senkou Span B.

- Represents dynamic support and resistance and trend strength.

How to Read the Ichimoku Cloud

The Ichimoku Cloud offers a wealth of information to traders, including trend direction, momentum, and key price levels. Here’s how to interpret its signals:

- Trend Direction:

- Uptrend: Price is above the cloud, and the cloud is green (Senkou Span A > Senkou Span B).

- Downtrend: Price is below the cloud, and the cloud is red (Senkou Span A < Senkou Span B).

- Consolidation: Price is within the cloud, indicating indecision or a range-bound market.

- Momentum:

- Tenkan-sen crossing above Kijun-sen signals bullish momentum.

- Tenkan-sen crossing below Kijun-sen signals bearish momentum.

- Support and Resistance:

- The cloud acts as dynamic support in an uptrend and resistance in a downtrend.

- Lagging Confirmation:

- The Chikou Span confirms the trend when it aligns with the direction of the price and stays above/below past price levels.

Trading Strategies Using Ichimoku Cloud

1. Trend Following Strategy

This strategy focuses on trading in the direction of the prevailing trend:

- Bullish Setup:

- Price is above the cloud.

- The cloud is green (Senkou Span A > Senkou Span B).

- Tenkan-sen is above Kijun-sen.

- Enter a long position when the above conditions align.

- Bearish Setup:

- Price is below the cloud.

- The cloud is red (Senkou Span A < Senkou Span B).

- Tenkan-sen is below Kijun-sen.

- Enter a short position when the above conditions align.

- Exit Strategy:

- Use the Kijun-sen as a trailing stop or exit when the price closes back within the cloud.

2. Breakout Strategy

The breakout strategy identifies potential trend reversals or continuations as price moves in or out of the cloud:

- Bullish Breakout:

- Price moves from below the cloud to above the cloud.

- Enter a long position after the breakout is confirmed with a strong close above the cloud.

- Bearish Breakout:

- Price moves from above the cloud to below the cloud.

- Enter a short position after the breakout is confirmed with a strong close below the cloud.

- Confirmation:

- Check the Chikou Span to ensure it supports the breakout direction.

3. Reversal Strategy

This strategy focuses on identifying potential reversals when the market is overextended:

- Bullish Reversal:

- Price approaches the lower edge of the cloud and shows signs of support.

- Enter a long position if the price bounces off the cloud with a bullish candlestick pattern.

- Bearish Reversal:

- Price approaches the upper edge of the cloud and shows signs of resistance.

- Enter a short position if the price reverses with a bearish candlestick pattern.

4. Cloud Thickness Analysis

The thickness of the cloud reflects market volatility and trend strength:

- Thin Cloud:

- Indicates weak support or resistance, increasing the likelihood of a breakout.

- Thick Cloud:

- Indicates strong support or resistance, making breakouts less likely.

Risk Management with Ichimoku Cloud

Effective risk management is crucial when trading with the Ichimoku Cloud:

- Position Sizing:

- Limit your risk to 1-2% of your account balance per trade.

- Stop-Loss Placement:

- Place stop-loss orders just below the cloud in an uptrend or above the cloud in a downtrend.

- Trailing Stops:

- Use the Kijun-sen or cloud edges as dynamic trailing stops to lock in profits.

- Avoid Overtrading:

- Trade only when clear signals align with your strategy.

Advantages of Using Ichimoku Cloud

- Comprehensive Analysis:

- Provides multiple layers of information, including trend, momentum, and support/resistance.

- Versatility:

- Suitable for various trading styles, including day trading, swing trading, and position trading.

- Clear Signals:

- Offers visually intuitive signals for entry and exit points.

- Dynamic Support and Resistance:

- The cloud adapts to market conditions, providing reliable levels.

Limitations of Ichimoku Cloud

- Complexity:

- The multiple components can be overwhelming for beginners.

- Lagging Nature:

- The indicator uses historical data, which may lead to delayed signals.

- Not Ideal for Range-Bound Markets:

- Works best in trending markets and may produce false signals in choppy conditions.

Tips for Effective Use

- Combine with Other Indicators:

- Pair Ichimoku with RSI, MACD, or Fibonacci levels for confirmation.

- Adjust Settings for Your Market:

- While the default settings (9, 26, 52) work well for many markets, you can adjust them based on the currency pair or timeframe.

- Practice on a Demo Account:

- Test your Ichimoku strategies in a demo environment before trading live.

- Stay Updated on Market News:

- Fundamental factors can influence trends, complementing the insights provided by Ichimoku.

Conclusion

The Ichimoku Cloud is a powerful and versatile tool for forex traders seeking a comprehensive view of market dynamics. By understanding its components and implementing well-defined strategies, you can effectively trade forex while minimizing risks. Although it requires practice and patience to master, the Ichimoku Cloud can become an indispensable part of your trading toolkit.