Bollinger Bands is a versatile and widely used technical analysis tool designed to help traders identify market conditions, gauge volatility, and make informed trading decisions. Created by John Bollinger in the 1980s, Bollinger Bands remains a cornerstone of trading strategies across forex, stocks, and cryptocurrency markets. This blog will explore what Bollinger Bands are, how they work, and how you can apply them effectively to improve your trading outcomes.

What Are Bollinger Bands?

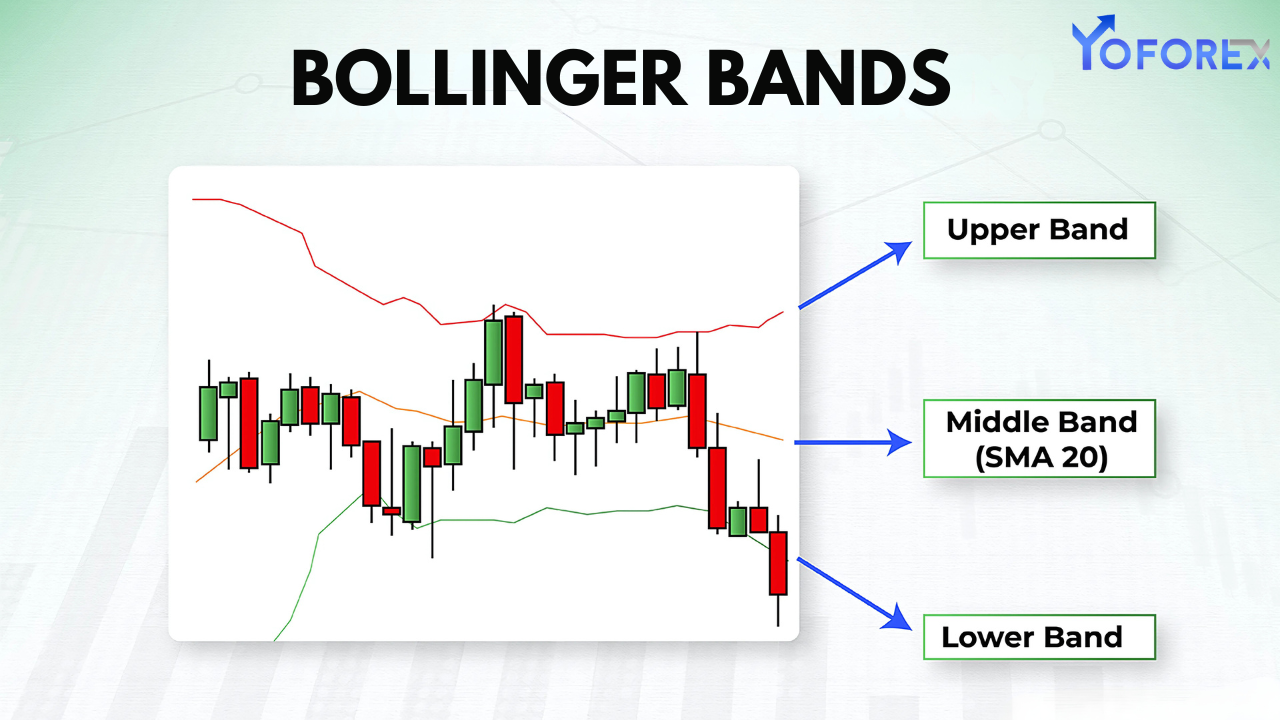

Bollinger Bands consist of three lines that form a band around the price action of an asset:

- Middle Band:

- This is a simple moving average (SMA), typically set to 20 periods.

- It represents the average price over the selected period.

- Upper Band:

- Calculated as the SMA plus two standard deviations.

- It provides an upper boundary for price action.

- Lower Band:

- Calculated as the SMA minus two standard deviations.

- It provides a lower boundary for price action.

The distance between the bands expands and contracts based on market volatility, offering insights into potential price movements and market conditions.

Key Concepts Behind Bollinger Bands

- Volatility Indicator:

- Bollinger Bands adjust dynamically to reflect market volatility. Wider bands indicate high volatility, while narrower bands suggest low volatility.

- Mean Reversion:

- Prices tend to revert to the mean (the middle band) after deviating significantly. This behavior makes Bollinger Bands effective for identifying overbought and oversold conditions.

- Trend Identification:

- The relationship between price and the bands can help traders identify trends and potential reversals.

How to Use Bollinger Bands in Trading

1. Identifying Overbought and Oversold Conditions

When price moves beyond the upper or lower band, it may indicate an overbought or oversold condition:

- Overbought:

- Price touches or moves above the upper band.

- Indicates potential selling opportunities.

- Oversold:

- Price touches or moves below the lower band.

- Indicates potential buying opportunities.

Example: In a forex market, if EUR/USD touches the lower band after a prolonged downtrend, it might signal an oversold condition, suggesting a potential reversal.

2. Bollinger Band Squeeze

A Bollinger Band squeeze occurs when the bands contract tightly around the price, indicating low volatility. This pattern often precedes a significant price move.

- Strategy:

- Monitor for a breakout beyond the upper or lower band after a squeeze.

- Enter trades in the direction of the breakout.

Example: In the stock market, if a stock’s bands narrow considerably, watch for a breakout that could signal a new trend.

3. Riding the Bands in Trending Markets

In strong trends, prices can “ride the bands,” staying close to the upper or lower band for extended periods:

- In an Uptrend:

- Prices often hover near the upper band. Look for buying opportunities on pullbacks toward the middle band.

- In a Downtrend:

- Prices often hover near the lower band. Look for selling opportunities on rallies toward the middle band.

Tip: Avoid interpreting a touch of the upper band in a strong uptrend as an overbought signal, as this could lead to premature exits.

4. Combining Bollinger Bands with Other Indicators

Bollinger Bands are most effective when used alongside complementary technical indicators:

- Relative Strength Index (RSI):

- Use RSI to confirm overbought or oversold conditions.

- Moving Averages:

- Combine Bollinger Bands with exponential moving averages (EMAs) for trend confirmation.

- Volume:

- Look for high volume during breakouts to validate the price move.

Example: In cryptocurrency trading, pairing Bollinger Bands with RSI can help identify high-probability reversal zones.

Advanced Bollinger Band Strategies

1. Double Bottoms and Double Tops

- Double Bottoms:

- Price touches the lower band, rebounds, and forms a second bottom within the bands. This pattern often precedes an upward reversal.

- Double Tops:

- Price touches the upper band, retreats, and forms a second top within the bands. This pattern often precedes a downward reversal.

Tip: Look for divergence in RSI or MACD to strengthen the validity of these patterns.

2. Bollinger Band Breakouts

Breakouts occur when prices close above the upper band or below the lower band:

- Bullish Breakout:

- Enter long positions when prices close above the upper band with strong volume.

- Bearish Breakout:

- Enter short positions when prices close below the lower band with strong volume.

Warning: Not all breakouts lead to sustained trends. Use stop-loss orders to manage risk.

Managing Risk with Bollinger Bands

- Set Stop-Loss Levels:

- Place stop-loss orders beyond the bands to protect against unexpected price movements.

- Adjust Band Settings:

- Experiment with different settings to suit your trading style. For example, use a 10-period SMA for shorter time frames.

- Avoid Overtrading:

- Not every interaction with the bands warrants a trade. Focus on high-probability setups.

Common Mistakes to Avoid

- Overreliance on Bands:

- Bollinger Bands are a tool, not a standalone strategy. Always consider market context and use other indicators for confirmation.

- Ignoring Market Conditions:

- In ranging markets, Bollinger Bands are effective for identifying reversals. In trending markets, they’re better suited for breakout strategies.

- Failing to Use Volume Analysis:

- Breakouts are more reliable when accompanied by high volume. Neglecting volume can lead to false signals.

Real-Life Example: Applying Bollinger Bands to GBP/USD

- Setup:

- On the daily chart, GBP/USD is consolidating, with narrowing Bollinger Bands indicating a squeeze.

- Observation:

- After several days of low volatility, GBP/USD breaks above the upper band with a strong bullish candle.

- Action:

- Enter a long position with a stop-loss below the middle band. Use the width of the bands to set a profit target.

- Outcome:

- The breakout leads to a sustained uptrend, allowing the trade to reach its profit target.

Conclusion

Bollinger Bands are a powerful tool for traders across all markets, offering insights into volatility, trend direction, and potential reversals. By understanding their mechanics and combining them with other indicators, you can enhance your trading strategy and make better decisions. However, like any tool, Bollinger Bands requires practice and experience to master. Start with backtesting on historical data, refine your approach, and always trade with disciplined risk management.

Whether you’re trading forex, stocks, or cryptocurrencies, Bollinger Bands can provide a significant edge in navigating the complexities of the financial markets.